How To Use Fintech Trends 2021 To Improve Your Business

IT copywriter

Reading time:

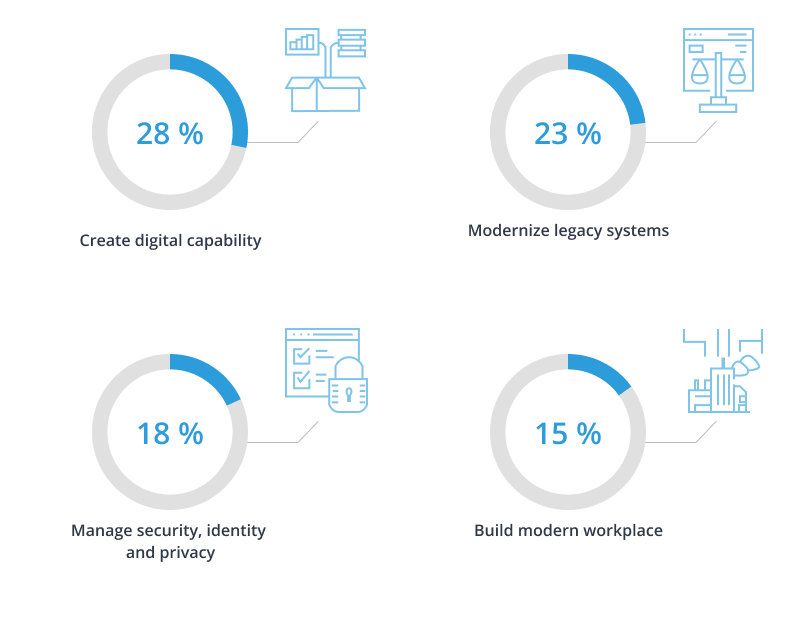

Statistics show that in 2020, 64% of consumers worldwide used at least one fintech platform, compared to 33% in 2017. Clearly, the popularity of fintech has doubled, so we should take advantage of it as soon as we can. Here are the fintech development areas that will be relevant within the next 12 months:

Source: Finances online

Let’s discuss the fintech novelties of 2021 and ways to use them for business.

New app features

Consumers are more demanding than ever. They want a personalized experience and multifunctional products. Developers should consider this when developing insurance, investment and financial software tools. Big banks like Bank of America or Royal Bank of Scotland are integrating new features in their apps such as automatic recurring payments so that their clients don’t have to keep all these payments in mind. Within the next year, banking app users will be able to get car insurance, perform real estate transactions, and even get goods delivered.

Business automation

The automation of routine and complex business processes will be another important fintech trend in 2021. For example, online banking will allow users to create electronic waybills, invoices, and other complex documents. Banking apps will provide legal and accounting services. This will free users from filling out and sorting hundreds of documents and allowing them to concentrate on more important things instead.

Blockchain technologies

The concept of blockchain emerged several years ago, and its full potential has yet to be realized. Nevertheless, it already assists in data protection, personal identification, company verification, transaction registration, investments, risk management, and contract signing. Because of the safety and reliability of the technology it is broadly used. In 2021, we can expect ongoing diversified development. The most promising area for fintech is cryptocurrency. Bitcoin will continue growing while other cryptocurrencies are trying to compete with it and stay afloat. The demand for these currencies is increasing, so more banking apps will allow users to work with them.

RegTech (regulatory technologies)

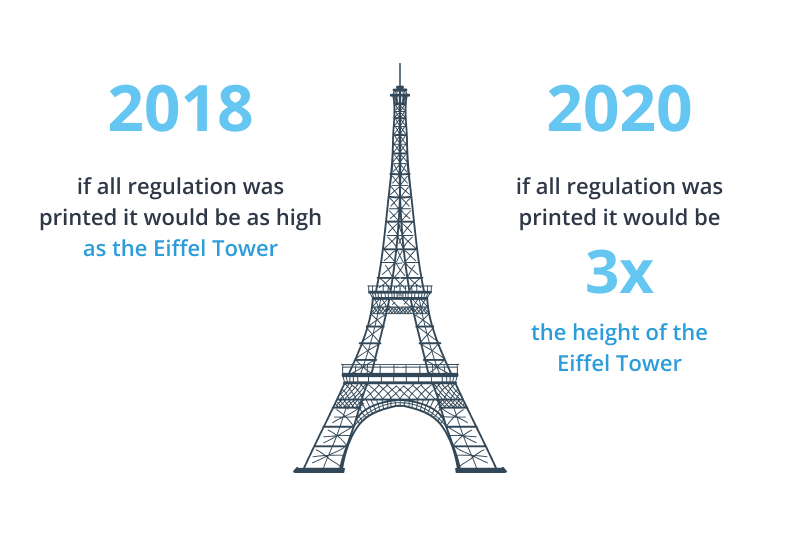

Government structures and financial markets set numerous requirements for banking structures. It is impossible to keep up with all of these rules, so companies spend substantial amounts of money on lawyers (at best) or fines (at worst).

Growth in the number of rules and regulations of government agencies and financial markets from 2018 to 2020

Source: A-team insight

It isn’t easy to follow every rule. However, regtech can help us with this. These technologies automatically track the correctness and legality of actions. Regtech’s tasks include customer identification, data processing and protection, financial risk analysis, and finding solutions to disputable situations. With it, organizations and individuals comply with regulations and avoid problems.

Open banking

Open banking allows reliable companies to securely work with bank customers’ financial information. This is a great trend for numerous fintech startups that are now dominated by the largest market players. According to the agency Mobile Payments Today, the number of open banking users doubled in 2020, so clearly now this area is worth paying attention to.

Previously, small fintech companies could not access clients’ banking information, which made it impossible to implement many of their ideas. However, open banking will finally enable them to compete for buyers, generating demand and profit. For example, open banking will allow developers to create apps that contain all financial information from different banks in one place. Users will receive a salary on one bank card, save money in another, and buy goods using the card with the highest cashback reward and incentives.

Financial ecosystems

The ecosystem concept is gaining momentum. Large companies such as Google or Facebook allow users to read the news, order a taxi, and listen to music without leaving their apps. In the financial area, developers will compete for customer loyalty too. Financial ecosystems for business will integrate information about products, customers, ads, and company profits. This will allow companies to consider the data as a whole and process it for the good of businesses and clients.

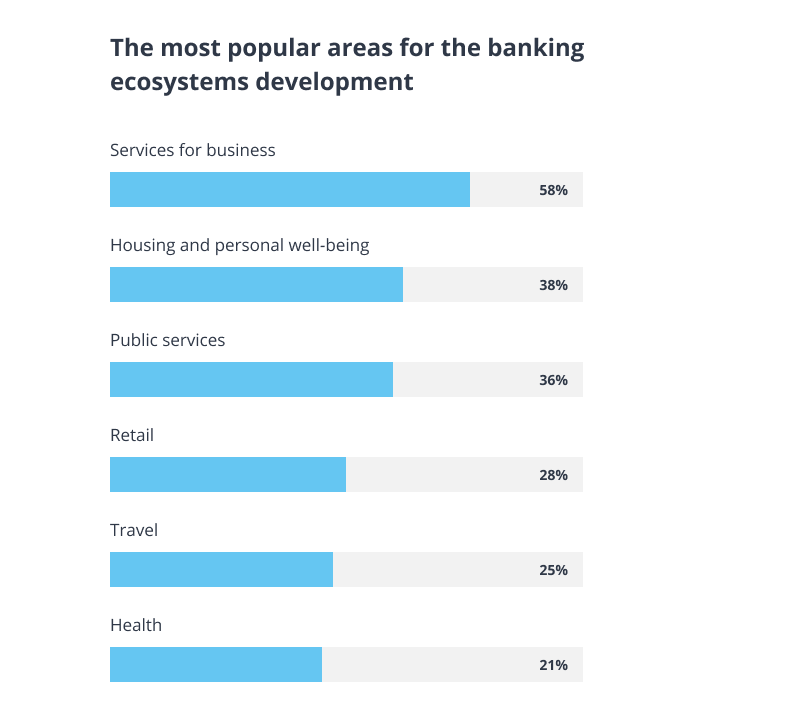

The most demanded areas of ecosystems are products for business (accounting, starting a business), housing (mortgage, security), and government services (fines, benefits). We at Azoft build products that meet these trends. For example, we have developed an app for city residents. With the help of this app they can draw the authorities’ attention to the infrastructure, roadways, transport hubs, lighting, cleaning, and other crucial issues of city life.

Here are the statistics on the key areas of banking ecosystems:

Source: Accenture

Biometric security systems

Cybersecurity has been an important concern for a long time, but the pandemic changed people’s approach to information security. Fingerprint recognition is one of the most popular technologies right now, but people need new, contactless ways to protect their data and identify themselves. In 2021, there will be an increase in the systems for recognizing the voice, pupils, ears, veins on the arms, and even DNA. According to the forecasts of Allied Market Research, the biometric technology market size is expected to reach $10.72 billion by 2022, showing a CAGR of 19.4% from 2016.

Speech recognition technologies

Technologies adapt to the active young audience that needs modern products and services. For example, more than a half of Americans regularly use voice assistants. Thus, they will be able to do more routine or repetitive tasks, allowing employees to focus more on tasks that require creativity and emotion. However, people are still vary of robots. This is why one important challenge in the near future will be convincing people of their reliability.

Online banks

Experts from Komando Tech state that Sweden will be the first country to completely stop using cash by 2023; the rest of the world will follow their example. As a consequence, there will be more banks that exist exclusively on websites and smartphones of users. Their customers will interact with banks through digital channels only. In 2021, large and new banks will follow this trend. Now, even older people are embracing technology more than ever. Hence, digitalization will not affect the size of the target audience too much. This means the main challenge is to make a user-friendly product that meets the customers’ needs.

Autonomous finance

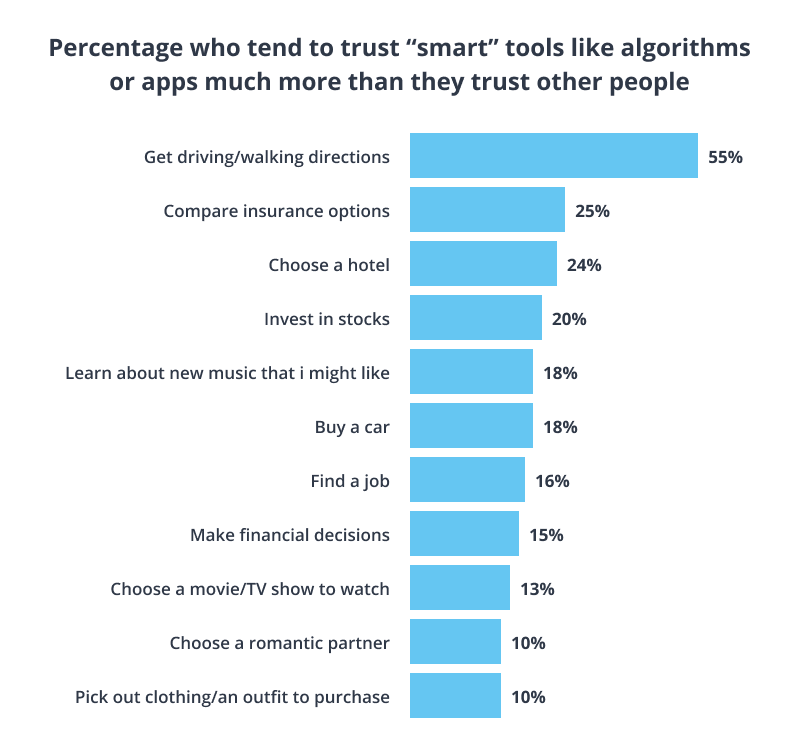

Many people lack basic financial literacy. However, they understand, at least on a superficial level, the importance of saving, investing, and spending their money wisely. This is why one of this year’s trends is apps that take care of the security of finances and maximize their capacity for growth. One future development we expect is an AI money manager that is accessible to the public. The machine will spend it on bills, investments, and savings, limited to the allocated amount. People will get the maximum benefit with the minimum losses of money and time. Undoubtedly, people still have difficulty trusting machines. However, they tend to delegate some tasks to robots instead of representatives of their own kind:

Source: Finn

Conclusion

Fintech development leads to spreading financial literacy and wealth growth. It will also make many businesses more successful and allow them to manage their funds better. 82% of traditional financial companies want to tackle fintech more closely in the next 3-5 years, so starting work in this area now would be a great idea. If you need help with your fintech project, don’t hesitate to contact us at info@azoft.com. We’ll gladly offer you a free consultation and become your technical partner.

Comments