Mobile Banking Development: When Finance Meets Mobile

IT copywriter

Reading time:

While many small and mid-sized financial institutions are watching mobile technologies from afar, weighing the pros & cons of investing in mobile banking development, other small players are successfully competing against banking giants through offering customers superior mobile services that provide more convenience.

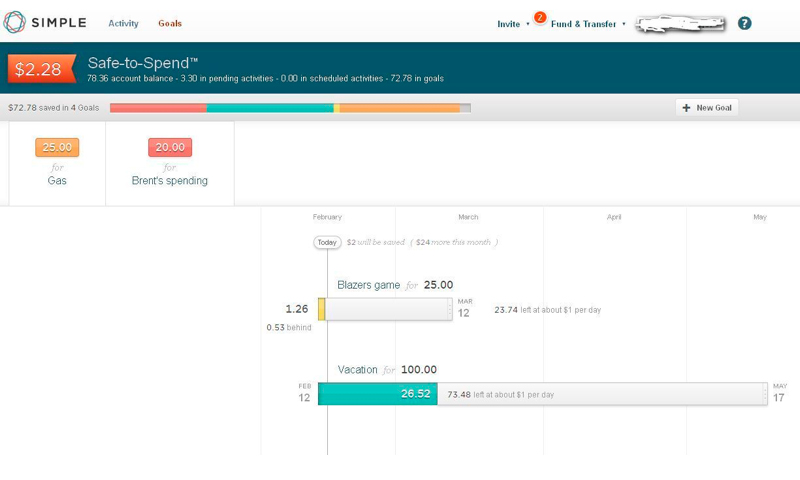

The website simple.com greets its visitors with the slogan: “Welcome to better banking.” Simple is a successful banking startup offering an attractive bundle of services: a bank account; a VISA card; and web- & smartphone-accessible money-management tools built right in. Launched in 2009, the company has attracted over 100,000 customers and processed more than $1.7 billion in transactions. Perhaps the next success will be yours?

Mobile solutions for financial institutions

Instant payments via always-at-hand smartphones providing simplicity and convenience: this is one of the benefits that mobile technologies can offer to all players in the financial industry. However, the absence of a mobile solution puts financial services companies at a competitive disadvantage.

With mobile, the more engaging of an experience you create, the more attention your brand receives — serving both to attract and retain customers. And in addition to providing real-time service & other benefits to customers, mobile solutions provide opportunities for companies to better understand their clients’ needs through the use of customer analytics derived from mobile stats — that can be applied to enhance services and fulfill these needs.

Currently, all mobile solutions imply mobile banking & payment apps and some of them deal with mobile money.

Mobile banking & payment apps

A standard mobile payment app replaces both a customer’s physical cash and credit/debit cards by using their iOS, Android or other smart devices. In general, it additionally offers access to the following anywhere, anytime services that allow users to:

- Make payments

- Transfer funds from one account to another

- Access savings, checking, loan accounts, etc.

- Locate branches and ATMs

- Get maps & directions

With an increase in the number of such apps of recent, it has become more and more difficult to stand out among competitors. After having analyzed hundreds of mobile apps, we have concluded that there are essentially four basic things that successful finance apps of all genres have in common:

They are multi-useful. The one-trick transaction app is dead. To engage tech-savvy users, the best apps offer services beyond just basic payment, money tracking & management tools: they establish partnerships with outside service providers and retail/food/entertainment establishments to enlarge their scope and appeal. Companies continue experimenting with new features to provide customers with a simpler, pain-free payment process for a more enjoyable customer experience.

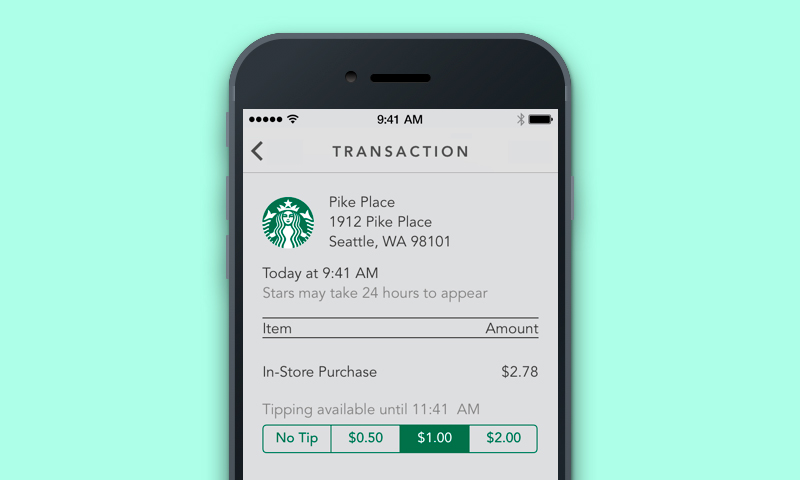

Starbucks recently announced an upcoming Digital Tipping feature built into its dedicated payment app.

They are super easy. Rich functionality is awesome — but usability is the bottom line. When it comes to mobile, a complicated app is a one-time-launched app. Even if it is technically cool and feature-packed if it’s not extremely user-friendly most people will choose to pay with cash or use plastic.

Combining complex features and presenting them in an uncomplicated way is exactly what Simple does.

They are secure. Mobile phones can and do get lost or stolen — but a good app will never expose any confidential data in these instances. Whatever method you choose: passcodes, secret questions, a remote wipe, etc. — your task is to ensure that your users feel confident their data is secure. However, be very careful not to overdo security procedures: obligatory complex passwords and other precautions greatly diminish the user experience. And in addition, from a development perspective, these measures are extremely time consuming and costly.

Note for mobile developers: Adhering to the established principles of secure development and performing penetration tests are obligatory requirements when developing banking applications dealing with confidential data. As a result, extra time should be expected, planned for, and considered when presenting job estimates.

They make users feel good. The rewards program is one of the most common marketing techniques used by companies. It’s simple: users get rewarded — receive bonus points, money-saving benefits, etc. — for making transactions with a company, via their mobile device in this case.

Another promotional approach is to establish partnerships with individual merchants and provide users with exclusive discounts and specials.

Mobile money

As mobile carriers go further into the bank-by-phone business, features offered by a checking account have become no longer the exclusive domain of the banking monopoly: mobile carriers are starting to provide an increasing number of banking services to their customers. M-PESA (Kenya), the mobile-cash pioneer with nearly 20 million users around the globe and T-Mobile USA are the dominant players presently; however, more and more ambitious, innovative startups are entering the scene.

Whether you want to call it a mobile banking revolution — or rapid fintech software evolution — there’s no doubt that innovation in delivering powerful mobile capabilities is what will heavily determine a financial institution’s success or failure in the future.

Mobile apps are capable tools that enable small companies to compete with industry giants — and win — by becoming the financiers who best satisfy all the needs of their tech-aware — and not-so-tech-aware — customers.

Comments